(Bloomberg) —

Renault SA and Nissan Motor Co. outlined a 23 billion euro ($26 billion) electrification plan that will deepen ties within the struggling Franco-Japanese alliance as competition intensifies.

The funds, announced separately by the carmakers last year, will be spent over five years to roll out 35 new battery-powered cars by the end of the decade across five common manufacturing platforms, the companies said Thursday. The move is a major departure from the Renault Zoe and Nissan Leaf electric cars that were developed and built separately.

The plans mark a step forward in the three-way alliance that also includes Mitsubishi Motors Corp. that’s still seeking to rebuild itself after nearly falling apart following the downfall of former leader Carlos Ghosn. After Renault and Nissan blazed an early EV trail with their best-selling Zoe and Leaf models, competition is heating up and the vehicles have since been leapfrogged by Tesla Inc. and Volkswagen AG.

“Three years ago the alliance was experiencing a crisis unprecedented in its history based on a lack of trust,” Renault Chairman Jean-Dominique Senard said during a presentation. “This period belongs to the past.”

What Bloomberg Intelligence says:

“EVs risk becoming a fiercely competitive market. It’s a strength for Nissan, Renault and Mitsubishi that they can utilize their alliance in that area. However, because the three companies’ main internal combustion engine-based businesses remain unsteady, resources necessary to effectively promote electrification may be scarce going forward unless they’re able to firmly revive their operations.”

— Bloomberg Intelligence analyst Tatsuo Yoshida

As part of the push, the alliance will slim down its number models to 90 from a current 100, while boosting shared underpinnings to more than 80% from 60% by 2026.

The alliance is also planning to unveil a fifth EV platform, adding to the four already developed. A new model to replace Nissan’s Micra hatchback will be produced in France alongside the Renault R5, the companies said. The platform building the key Nissan Ariya EV crossover and the Renault Megane E-Tech will add more than 15 models by 2030 to manufacture as many as 1.5 million cars.

Mitsubishi, the smallest of the trio, will boost its presence in Europe with two models based on Renault vehicles. In addition, Nissan will take the lead on developing solid-state battery technology while Renault will work on a model enabled for over-the-air software updates.

“These are massive investments that none of the three companies could make alone,” Senard said in a statement.

Renault rose as much as 2.9% in Paris trading, compared with a gain of 0.4% in the STOXX Europe 600 Automobiles & Parts Index.

Road Map

The latest road map for the alliance, which began in 1999, marks a focus on practical ways for the automakers to pool their resources, even as the imbalance in the cross-shareholding tie-up remains.

Renault holds a 43% stake in the bigger Japanese company with voting rights, while Nissan owns 15% of Renault and has no voting rights. This has been an unresolved source of tension although the partners have said their primary focus is making the alliance work better operationally.

Read more: Carlos Ghosn’s Downfall at Nissan and the Aftermath: QuickTake

Nissan in November outlined 2 trillion yen ($17.5 billion) of investment over the next five years on EVs and batteries including 15 new electric models and a pilot plant for solid-state batteries in Yokohama.

In June, Renault mapped out a 10 billion-euro EV bet on battery supply, powertrains and new models. It plans to introduce ten new battery-powered cars by 2025, including in the higher-margin SUV segment.

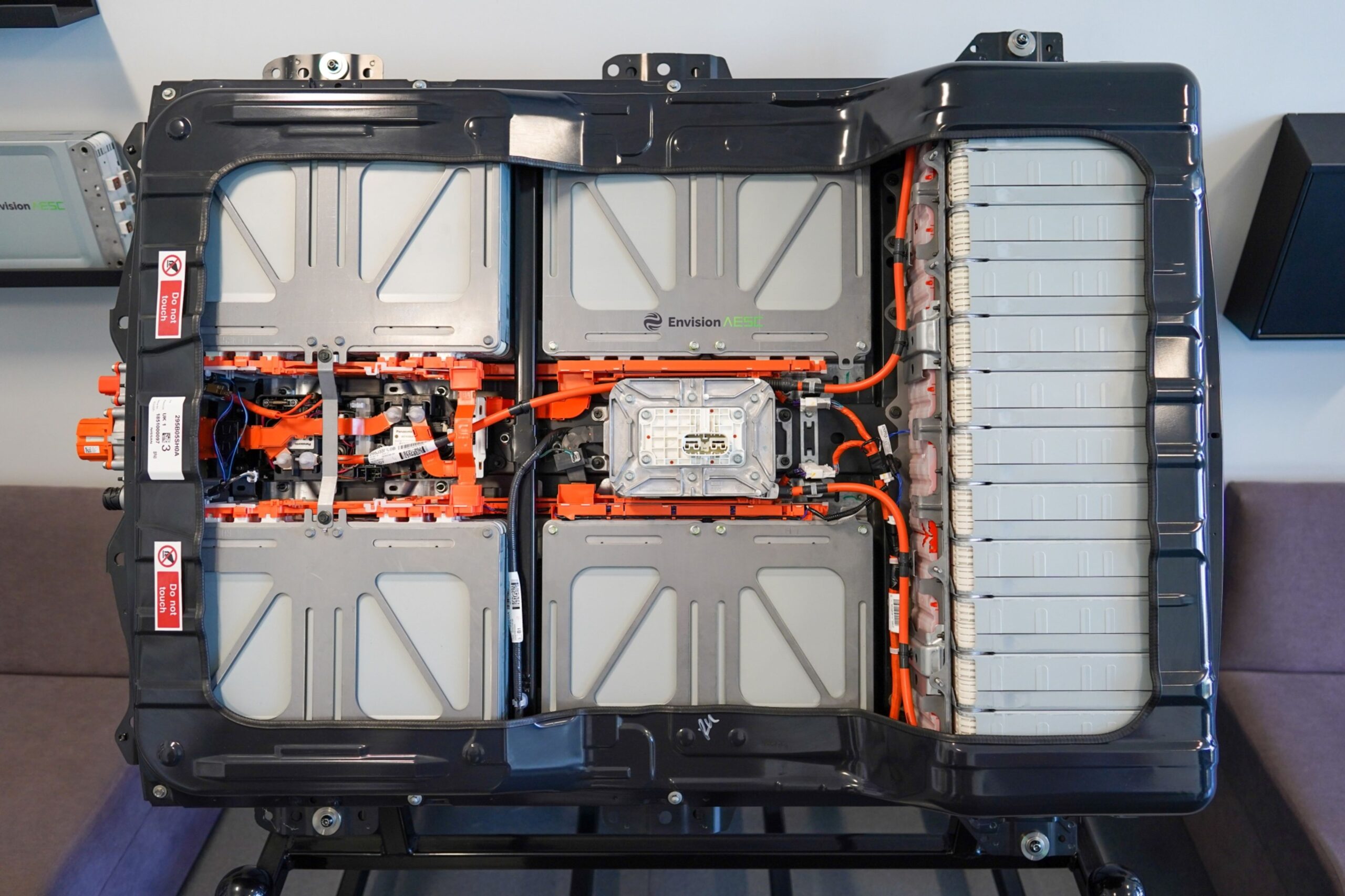

Nissan and Renault, which are both working on turnaround plans, have already agreed to supply deals with China’s Envision Group, which is set to spend as much as 2 billion euros on a battery factory near Renault’s auto plant in Douai, France and invest in cell making at a Nissan plant in the U.K.

“Leader-Follower”

The alliance last outlined a common strategy in May 2020 in the form of a “leader-follower” system, where each company would occupy the driver’s seat in certain regions and for some technologies and take the back seat in others. That plan hasn’t completely taken with Renault seeking to forge its own path in China.

Read more: Renault Rips Up Nissan Alliance Script for China Traction

Keeping the partnership together has been made more difficult by pandemic travel rules that have mostly prevented top executives from meeting in person. Rival carmakers Fiat Chrysler and PSA Group combining last year to form Europe’s second-biggest carmaker — Stellantis NV — has also dialed up the pressure.

© 2022 Bloomberg L.P.