Utah is uniquely positioned to capitalize on America’s clean energy transition. Since 2022, the Inflation Reduction Act (IRA) has created substantial economic opportunities for clean energy across the state. The law continues to unlock new potential in various energy sectors, including carbon capture, utilization, and storage (CCUS), where Utah holds distinct geographical advantages.

CCUS consists of collecting carbon dioxide from industrial point sources with facility modifications or from the atmosphere with direct air capture (DAC) and either using it or sequestering it in deep geological formations, such as depleted oil and gas reservoirs.

“With an abundance of sandstone, limestone, and basalt rock layers, Utah has favorable geology for long-term geologic sequestration of CO2,” notes Julia Mulhern, Ph.D., from the Utah Geological Survey. This natural advantage makes Utah an ideal location for retrofitting existing infrastructure and developing future industrial facilities near areas where carbon could be sequestered into the ground.

The Utah Geological Survey highlights that the IRA increased the 45Q tax credits associated with CCUS in Utah, which were initially introduced in 2008. First, the legislation raised the tax credit value per metric ton of CCUS; the credit per metric ton for point-source capture increased from $50 to $85, and the credit per metric ton for direct-air-captured and stored carbon increased from $85 to $180, for example. More plants also qualify for the credits than before. The start date deadlines were extended from the beginning of 2026 to the beginning of 2023, and the annual carbon emissions thresholds were lowered: power plants need to emit 18,750 metric tons instead of 500,000, and both industrial facilities and DAC facilities need 12,500 metric tons instead of 100,000. Plus, the ability to use direct pay instead of tax deductions makes it easier for companies to receive these credits. Overall, the IRA incentivized more companies to implement CCUS by creating more economically viable opportunities for industrial facilities to reduce emissions while boosting their bottom line.

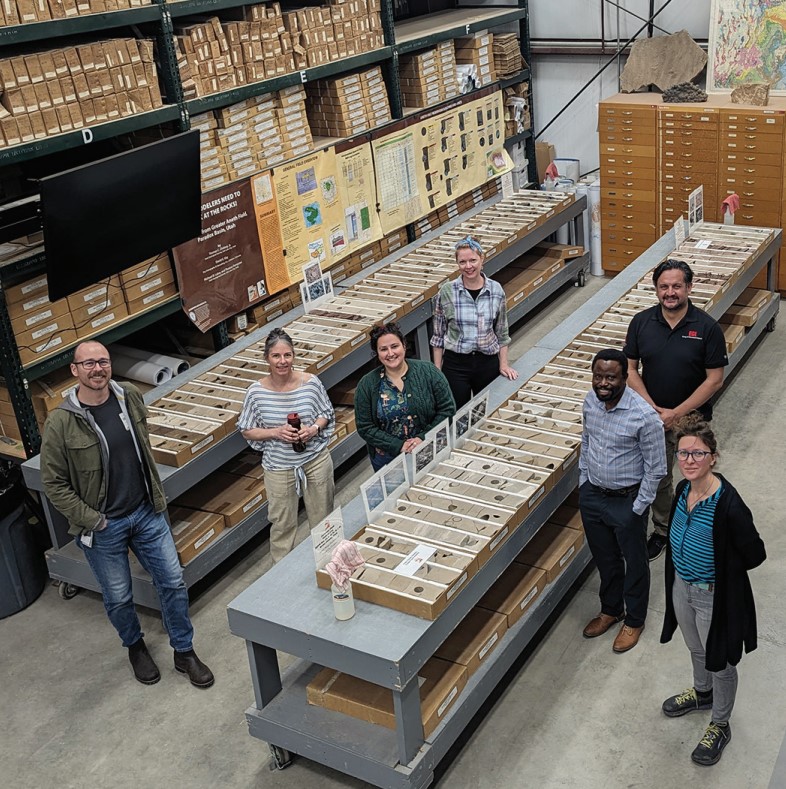

Photo Courtesy Utah Geological Survey

The implications are significant in Utah. The IRA increased the number of facilities in the state eligible for carbon capture tax credits from 41 to 62, with qualifying operations now spanning the state’s geography.

Due to the new $85 credit per metric ton for point-source emissions, coal-fired power plants can now retrofit their facilities with CCUS technology. For example, the Hunter Power Plant in Emery County releases about 8 million metric tons of carbon annually. If 80 percent of those emissions were captured and stored, it would generate about $538 million annually in tax credits.

The oil and gas industry also stands to benefit. With the increased 45Q tax credits, active oil and gas fields in the Uinta Basin could host enhanced oil recovery, in which carbon is injected to maximize extraction. This would maximize the use of the existing resources and infrastructure. Abandoned oil and gas wells in Utah could also be adapted for carbon storage.

Utah’s geothermal resources provide another avenue for economic growth. The state is exploring how carbon capture technology could couple with geothermal energy production, potentially creating a new energy sector for Utah.Overall, the Utah Geological Survey explains that ”the 45Q tax credits create more economically viable opportunities for industrial facilities and companies in Utah to reduce emissions and meet climate goals set forth by the federal government.” As lawmakers explore policies relating to carbon capture, the Utah Geological Survey is a great resource to examine the IRA’s impact on Utah’s carbon capture utilization and storage investments.

This article was created on March 6, 2025 with the assistance of the generative artificial intelligence (AI) tool Claude 3.7 Sonnet, using the linked company websites, press releases, reports, or external media coverage as inputted source material. It was then reviewed, fact-checked, and edited by one or more team members to ensure factual accuracy and consistency with editorial standards before publication.

While we strive for precision, reliability, and quality, readers should be aware that AI-generated content may have limitations in contextual awareness and nuance and may not be completely unbiased, consistent, error-free, or up-to-date. We recommend using this content only for informational purposes, as well as independently verifying it or conducting further research to supplement it. If you notice any inaccuracies or have concerns about this content, please contact our research manager at greg@consensus-digital.com.