Hyundai announced it would offer car buyers $7,500 in cash bonuses for electric vehicle (EV) purchases in the United States — the deal expires on April 1. The Korean automaker is trying to compete with the Inflation Reduction Act’s (IRA) EV tax credits. The Ioniq 5, Ioniq 6, and Kona Electric were discounted until the end of January.

The Inflation Reduction Act has changed the car-buying industry. The tax breaks for purchasing specific North American-produced EVs have made customers more open to buying domestic models. The new law has irked some European and Asian brands with a substantial presence in the U.S. Hyundai had to think creatively to match the $7,500 tax credits American EVs can benefit from.

Hyundai and its subsidiary Kia were the second-highest-selling EV brand in the U.S. in 2023. They beat out GM, Volkswagen, and Ford while trailing behind Tesla by a massive margin. Tesla is one brand that qualifies for multiple IRA tax breaks. Elon Musk’s EV company continues to stand at the top for its reliability and charging network.

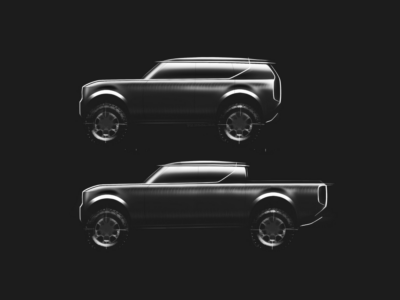

Photo Courtesy Hyundai Motor Group

After Tesla, the list of North American EVs that qualify for IRA tax breaks is slim. Ford, GM, and Rivian are the brands that reap the full benefits. Chrysler, Jeep, and Dodge get half-credits since they are part of Stellantis, based in the Netherlands. Fisker, the California-based niche EV producer, doesn’t get any benefits since their vehicles are manufactured in Austria. Lucid’s cars price themselves out of the tax threshold.

Hyundai’s Ioniq 5 and 6 are incredibly popular, as are Kia’s growing line of EVs. Competing with the IRA’s tax breaks is no easy challenge.

Hyundai is adding innovations, though, such as crab-walking cars that parallel park themselves. There are ways to stand out besides price.

The federal government is using the IRA to revive America’s auto industry while phasing out fossil fuels. The country’s decarbonization focuses heavily on zero-emission vehicles. Factories from America’s Big 3, multiple niche EV brands, battery producers, and various international auto groups open almost annually. More EVs are produced than ever before, with sales reaching a milestone in 2023 and charging infrastructure catching up.

Photo Courtesy Hyundai Media Center

There are also federal limits coming for Chinese critical minerals in EV manufacturing. Most battery minerals are sourced from China, as are many cells and components. The government’s decarbonization plan emphasizes sourcing minerals within North America rather than relying on foreign suppliers.

Due to the IRA’s selective nature, European and Asian brands not being able to participate in the tax credits could hurt business deals in the future. Hyundai’s cash bonuses plan could start a trend among foreign automakers to match the discounts. It is hard to beat Tesla’s price and reliability, which continue to dominate the American and European EV markets. Lobbying groups are hoping more foreign brands will be grandfathered in through free-trade agreements.