In June, the International Energy Agency (IEA) released its tenth World Energy Investment report. According to the report, in 2024, total power investment reached $1.5 trillion, an 8% increase year-over-year. The IEA added that even though the world this year faces both geopolitical strife and economic uncertainty, “capital flows to the energy sector are set to rise in 2025 to USD 3.3 trillion, a 2% rise in real terms on 2024.” $2.2 trillion of that investment will head into a variety of clean technologies and solutions around the world: renewables ($780 billion), efficiency and end-use ($773 billion), grids and storage ($479 billion), nuclear ($74 billion), and low-emissions fuels ($40 billion). Meanwhile, only half that, approximately $1.1 trillion, will go toward oil ($535 billion), natural gas ($365 billion), and coal ($248 billion).

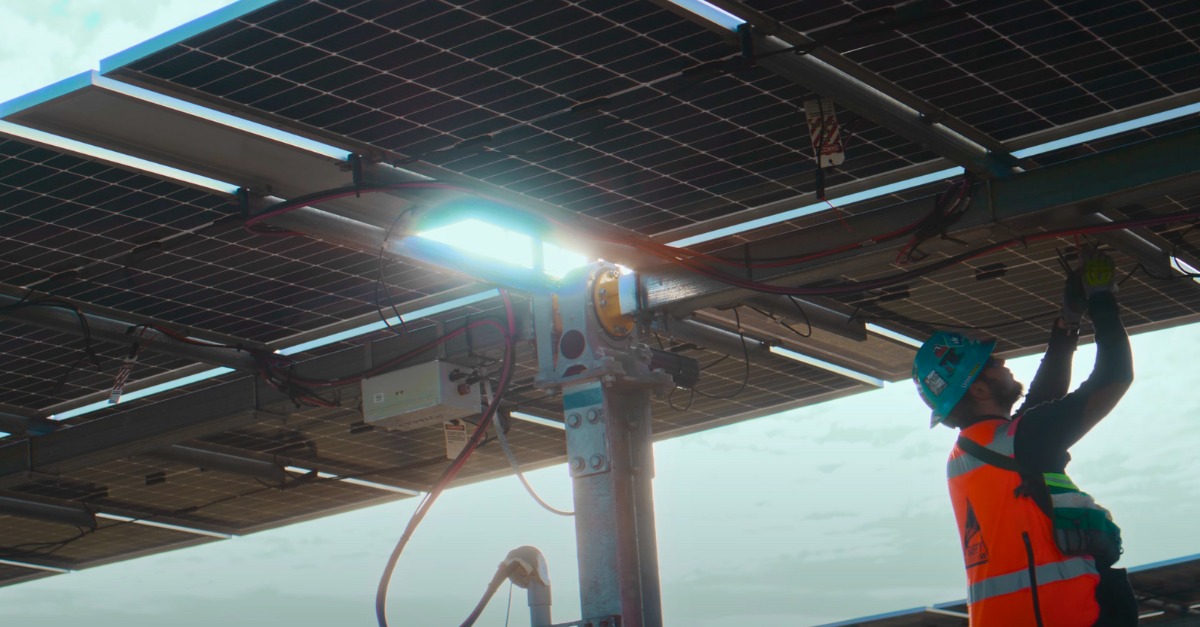

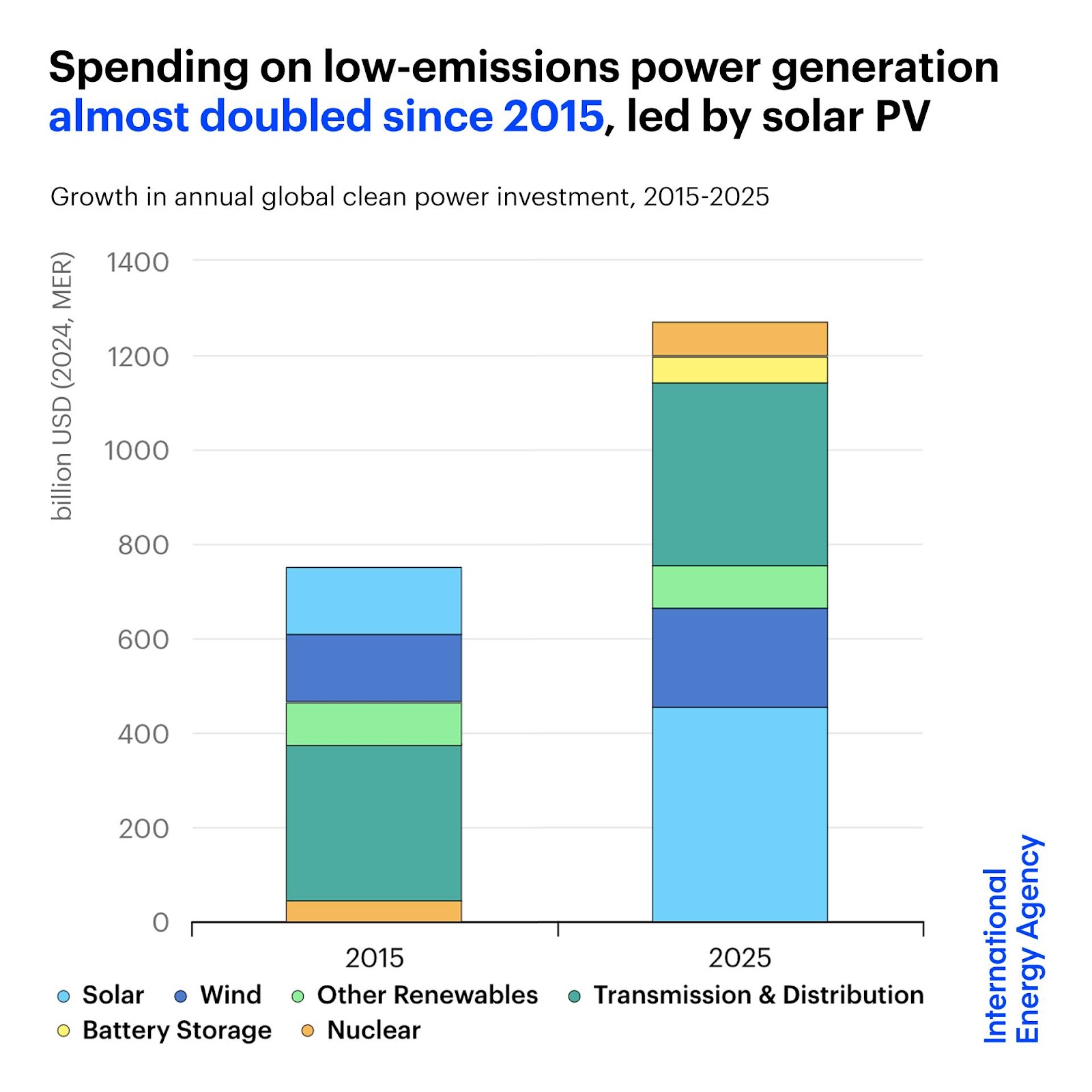

Investment in low-emission power generation has nearly doubled in the past five years, with solar in the lead. The IEA projected that investment across utility-scale and rooftop solar systems will hit $450 billion this year, a significant chunk of the $780 billion projected for renewables, “making it the largest single item in our inventory of the world’s investment spending.” But last year’s historically low levels of solar module prices led to a decline in spending on solar.

Photo Courtesy International Energy Agency (IEA)

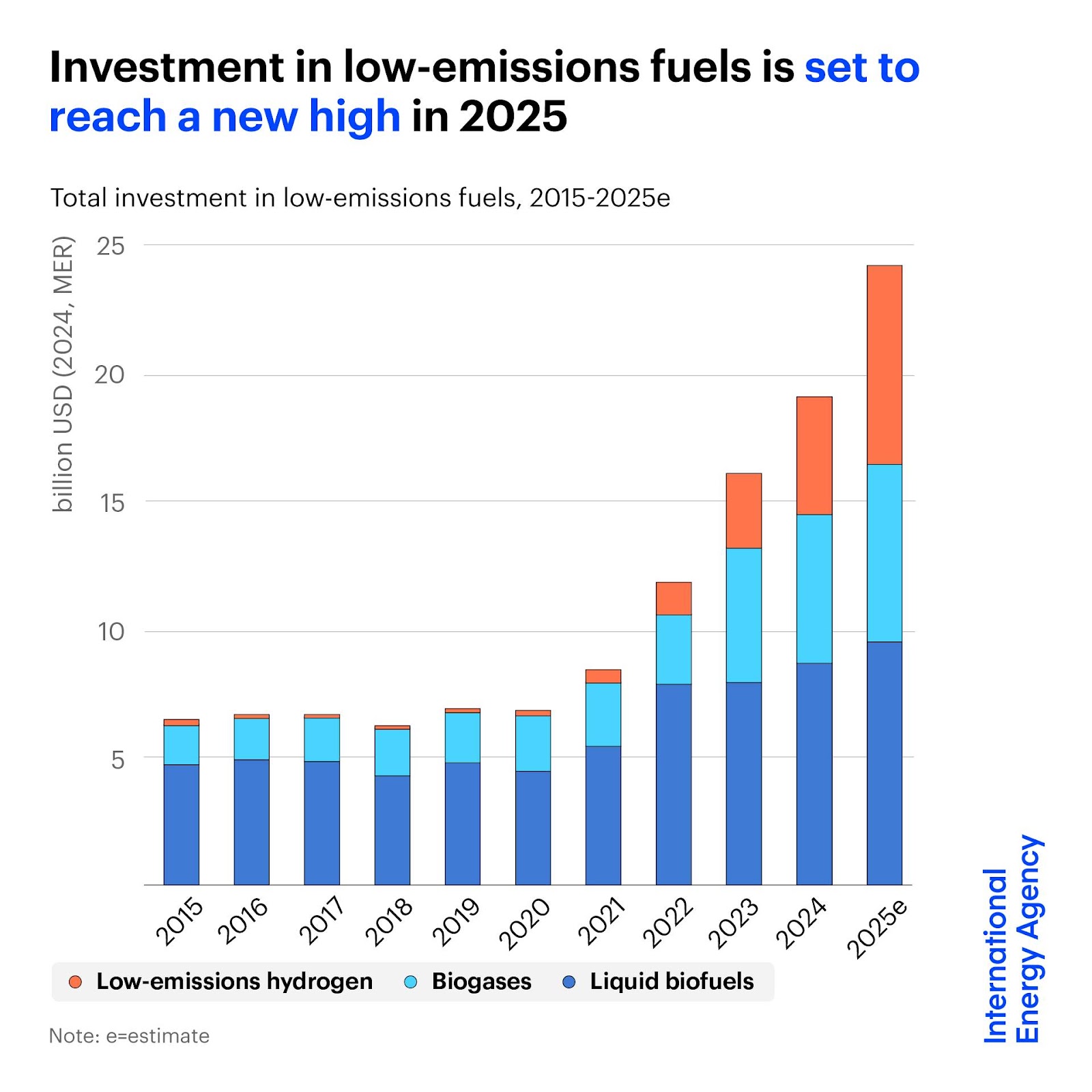

The report highlights nuclear and low-emissions fuels as rising stars. Spending on nuclear has risen by 50% in the past five years, with small modular reactors attracting significant interest. Spending on low-emissions fuels has hit an all-time high, having risen 20% in 2024, and is expected to rise another 30% in 2025. Electrolyzers are expected to see a 150% year-over-year increase, while bioenergy is expected to see a 13% year-over-year increase. However, investment in low-emissions fuels is still relatively low compared to total investment, and the hydrogen sector in particular has seen several cancelled projects and will need support from policymakers. However, the $8 billion pipeline of approved hydrogen projects this year is more than twice the size of last year’s pipeline.

Photo Courtesy International Energy Agency (IEA)

Investments in electrification and efficiency have also nearly doubled, but over a more extended period than power generation, spanning approximately the past decade. In 2025, this investment is projected to hit almost $800 billion. A large portion of such investment can be attributed to the electrification of vehicles and industrial processes, as well as efficiency gains in buildings.

For example, annual spending on electric vehicles and improved internal combustion engine efficiency has increased by a factor of five over the past decade and will reach $220 billion this year. Electric vehicles accounted for more than one in five car sales last year, compared to just 1% a decade ago.

On the other hand, global investment in building energy efficiency increased only marginally year-over-year in 2024, with fewer retrofits and building envelopes occurring due to trends like more expensive materials and a slower real estate sector. “Aligning affordability and profitability through consistent regulatory frameworks and well structured financial mechanisms is a condition to accelerate electrification in the building sector,” the IEA wrote.

Photo Courtesy ChargePoint

While more than $400 billion is projected to be spent on the grid for the first time this year, the IEA notes that it is not enough to keep up with the approximately $1 trillion spent on generation annually. For every $1 in new generation capacity, only about $0.40 is currently spent on the grid.

The report highlights long permitting processes and limited supply chains for cables and transformers among the hold-ups. For example, it can take between two and three years to procure cables and up to four years to procure transformers. “Maintaining electricity security amid rising electricity use requires a rapid increase in grid spending, moving towards parity with the amount spent on generation,” the IEA argued. “Manufacturers need greater visibility of project pipelines and future demand to justify new capacity investments.”

However, grid spending is still on an upward trajectory, having increased by 9% in 2024 compared to 2023, while the cost of utility-scale batteries has decreased by two-thirds since 2015.

Photo Courtesy Siemens Energy

Energy spending is coming from around the world. While China will lead the world in both clean energy investment ($627 billion) and fossil fuel investment ($257 billion) this year, the United States ranks second in both, with $400 billion for clean energy and $187 billion for fossil fuels. In fact, net fossil fuel importers like China were responsible for 69% of the increase in energy spending from 2020 through 2025, while the U.S. was responsible for 19%. The report attributed China’s share to its desire to be a leader in new technologies, and the U.S.’s share to a desire to combat China’s supply chain dominance. However, the IEA acknowledges that developing economies, particularly in Africa, are having a more difficult time. Only 2% of clean energy investment has come from the continent, even though it is home to 20% of the global population, and its 2025 energy investments were one-third lower than they were a decade ago.

The report notes that the past five years’ trend of increased energy spending was “kicked off by post-pandemic recovery packages and then sustained by a variety of economic, technology, industrial and energy security considerations, not only by climate policies.” Now, the trend is being fueled by the ‘Age of Electricity,’ with energy demand spiking to feed artificial intelligence cooling systems, data centers, electric transportation, and industrial needs. In the past two years alone, annual investments in data centers have increased by 67%. The IEA expects $4.2 trillion to be invested in data centers between 2025 and 2030, which will necessitate an additional $170 billion in generation investment over the same period.

“The need for adequate, timely investment remains as important as ever for energy security, sustainability and affordability,” the IEA concluded. “Today’s energy decision makers are facing new geopolitical tensions and the risk of energy shocks remains high. However, they have at their disposal a much broader range of highly competitive new technologies than was the case in 2015, and an accumulated wealth of policy experience on how to accelerate their deployment.”