Mineral recycling is one of the best ways to preserve and reuse critical materials like lithium, cobalt, copper, and battery cells for electric vehicles (EVs). Demand for these metals is rising as EV adoption increases. These materials are also used in solar panels and renewable energy systems.

Several private companies like Redwood Materials have gotten deep into the recycling business, giving expired EV batteries a second life and reusing minerals from old electronics. We asked an expert about the benefits of mineral recycling and why certain renewable energy sources are booming compared to others.

Tessa Lee, a former researcher at the Department of Energy’s Idaho National Laboratory and current waste consultant at Industrial Economics Inc., explained to The Business Download why solar and wind are becoming the primary renewable energy sources over hydropower and hydrogen, despite their critical mineral needs, especially in solar.

Photo Courtesy Ames National Laboratory

“Solar power can be generated when the sun shines, and wind power can be generated at any time of the day whenever there’s a draft,” Lee said via email. “They are cheaper to run than fossil fuel power generation due to ‘free’ availability of sunlight and low maintenance costs. They also create new jobs and power rural areas.” Even though solar panels require large amounts of zinc, silicon, and copper, the unlimited source of power and the economic benefits are worth the investment in manufacturing and technical skills.

During her master’s study at Yale University, Lee studied the clean energy transition and decarbonization, focusing on material flow model analysis. She worked on demand-side models for closed-loop recycling systems for solar and wind. She co-authored life cycle assessment (LCA) papers with Dr. Yuan Yao and Reid Lifset on biochar, material efficiency, and eco-modulation in extended producer responsibility.

She also worked at the Ames National Laboratory in Iowa and the Environmental Research & Education Foundation (EREF). The foundation is working toward better waste management and decarbonization through scientific solutions, including mineral recycling.

One critical mineral that is a hot-button topic is lithium. The U.S. domestic supply is still being discovered, with the government typically importing it from countries like Australia, Argentina, Chile, and China. Geopolitical tensions and natural disasters have disrupted supply chains in the last few years, so finding a domestic source would speed up the EV transition and renewable energy adoption. That’s where mineral recycling can play a vital role.

“Many of the minerals in EVs, wind turbines, and solar panels can be partially extracted at end-of-life and repurposed into new equipment,” Lee explained.

“Currently, however, there’s simply not enough equipment reaching that end-of-life phase to significantly offset shortages in material supply.”

More renewable energy gear is expected to come offline each year leading up to 2030, allowing recycling firms more chances to extract critical minerals. They would reinject these second-life materials into the domestic supply chain, where they can be reused in specific amounts.

“Toward the second half of the 21st century, research suggests the energy system will reach a near-steady state where the number of renewable energy technologies being built will equal those produced as waste,” she continued. “In my research project supported by EREF, we investigated strategies for reducing material requirements. We found that a successful closed-loop recycling system is a crucial part of securing a stable mineral supply in the U.S. and could also reduce the need for intensive mining of critical minerals.”

In the same study that Lee cited, researchers suggested that the world will face lithium and cobalt shortages in the next three decades if recycling programs are not improved or adopted. Though there are more advancements in mining and sourcing lithium, recycling is far healthier for the planet than opening new mines.

Photo Courtesy Curioso Photography

The advancements in mining and sourcing are driven by the growth of another technology: artificial intelligence (AI). AI’s integration into critical material supply chains has allowed some companies to make more planet-friendly choices.

“AI can analyze large amounts of data to find the most efficient and cost-effective production routes,” Lee agreed.

“AI-powered technologies can analyze geological data to identify new mineral deposits. This speeds up the discovery of viable mining sites, which reduces the time and cost associated with exploration.”

It can also create data-based forecasts for future mineral needs and trends in renewable power. They’ll also be able to anticipate future shortages.

Mineral recycling has a long way to go before providing a large amount of second-life materials, though. Lee says that investment in recycling infrastructure is needed. Waste is expected to increase in the next two decades, requiring more recycling options for EV batteries, wind turbine blades, solar panels, and other cleantech.

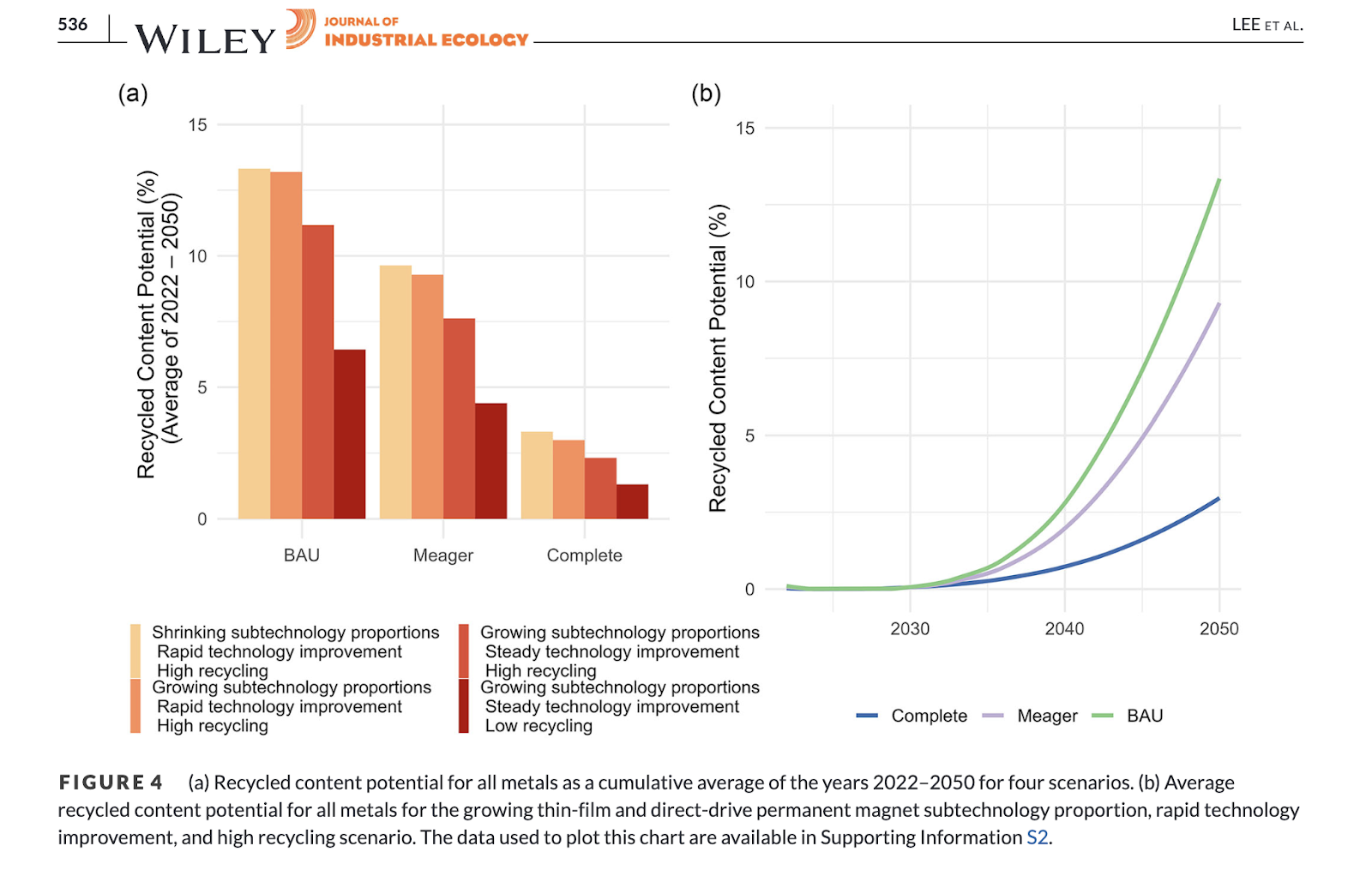

“In my research, we modeled four technology development scenarios for wind and solar energy against three decarbonization rates — Complete, Meager, and Business as Usual (BAU),” she explained. “We then calculated the projected average recycled content potential (%) from 2022–2050 (the proportion of virgin material demand that could be satisfied by recycled material).”

“The results showed that the best-case scenario for reducing the demand for virgin critical minerals entailed shrinking the proportions of mineral-intensive sub-technologies, rapidly improving efficiency, and achieving high recycling rates,” she continued.

“This resulted in an average recycled content potential of about 13% in 2050 for the BAU scenario.”

Graphic Courtesy Tessa Lee

If the U.S. wants to become more self-sufficient in its green economy, it must invest more in mineral recycling and sustainable solutions. The Inflation Reduction Act has got the ball rolling with its cleantech and EV tax credits, but private industry still needs more to get its innovations up and running.

Some, like Redwood, are lucky enough to have backing from brands like Audi and General Motors and U.S. government agencies. Hopefully, with the advancements in AI and mineral sourcing, more private companies will have investment opportunities open up for them.