Not a fan of electric vehicles (EVs)? You may want to rethink that if you want to save some cash! Clean vehicle tax credit guidelines revealed by the IRS in October 2023 offer tons of discounts for the average American motorist.

There’s more clarity about which EV brands qualify for tax credits and which don’t, as well as income thresholds, standards for used cars, and more. Here’s how you can save money when buying an EV.

How Do I Qualify For New Car Credits?

The IRS says that electric cars qualify for up to $7,500 in tax credits, but it’s not as simple as that. Multiple publications have reported the criteria as a North American-built plug-in hybrid, EV, or fuel-cell vehicle. The car must be purchased in 2023 or later. It must be for personal use, can’t be re-sold, and is primarily used in the United States.

Adjusted gross income also determines whether someone gets the full tax credit. You are disqualified for tax credits if you make more than $300,000 as a married couple filing jointly, $225,000 as head of household, or $150,000 for all other filers.

The car has to be assembled in North America and must meet several critical mineral requirements to earn the $3,750 mineral credit.

That’s only partial credit, though. Forty percent of the minerals must come within the U.S. or one of the countries Uncle Sam has a fair trade agreement with. There are currently 20 countries with which the U.S. has a free trade agreement, and Japan has EV-specific trade deals with Washington.

The other $3,750 credit is based on 50% of battery components. They have to be manufactured in the U.S. or a fair trade-listed country. Mineral requirements are increasing annually until 2027, and battery component requirements will increase until 2029. The entire battery component has to be assembled in North America or a fair trade nation by the next decade.

Photo Courtesy Ernest Ojeh

EV MSRP is another factor to consider. A $4,000 credit was inserted into the guidelines for EVs below $25,000. However, discounts for low-cost EVs are subject to income. Any EV below $55,000 will receive revised credits. Any van or SUV up to $80,000 gets them, too.

How Do I Qualify For Used Car Credits?

You might be curious about used EV tax breaks. Don’t worry: the IRS has guidelines for them as well.

As of Jan. 1, 2023, if you purchase a qualified used EV or fuel cell vehicle from a licensed dealer for $25,000 or less, you may be eligible for tax credits. However, qualifying is like trying to meet the criteria for the Nobel Peace Prize. Not everyone can win it, and meeting the standard is incredibly complex.

The IRS says that a used EV must be for personal use, not resale. The owner must not be the original owner, not claimed as a dependent on a tax return, and haven’t claimed another used clean vehicle credit in the three years before the purchase date. Additionally, a person’s average income can’t exceed $150,000 for married couples filing jointly, $112,000 for heads of household, and $75,000 for all other filers.

Meanwhile, the car itself has to cost $25,000 or less. The model has to be at least two years younger than the calendar year it was purchased.

If you bought a 2022 used Tesla in 2024, you would qualify for used vehicle tax credits. However, any car transferred after Aug. 16, 2022, is not eligible.

There’s even a weight requirement: the car has to weigh less than 14,000 pounds. It also must possess a battery capacity of 7 kWh. Finally, and it goes without saying, it has to be driven primarily in the U.S.

All purchases of clean vehicles, used or new, must be done at a dealer to receive federal tax credits. The good news is the revamped tax codes allow buyers to get their tax credits at the point of sale rather than waiting to file taxes.

Photo Courtesy Robin Mathlener

What Brands Qualify For Credits?

Domestic-produced EVs qualify instantly for the clean vehicle tax credit, but not every model does. The eligible brands are Chevy, Ford, Rivian, and Tesla. Plug-in hybrids from Chrysler, Ford, Jeep, and Lincoln also qualify. See the list below to see which make and models are included:

- 2022–2023 Chevy Bolt EV

- 2022–2023 Chevy Bolt EUV

- 2022–2024 Ford F-150 Lightning (Standard Battery Range)

- 2022–2024 Ford F-150 Lightning (Extended Battery Range)

- 2022–2024 Ford Escape Plug-in Hybrid

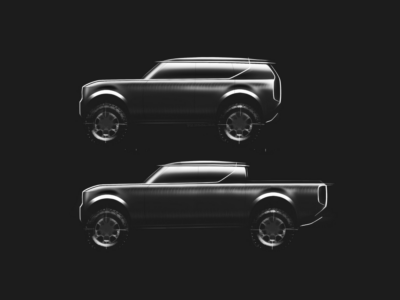

- 2023–2024 Rivian R1T (Dual Large)

- 2023–2024 Rivian R1T (Dual Quad)

- 2023–2024 Rivian R1T (Dual Max)

- 2023–2024 Rivian R1S (Dual Large)

- 2023–2024 Rivian R1S (Quad Large)

- 2023–2024 Tesla Model 3

- 2023–2024 Tesla Model Y (All Wheel Drive)

- 2023–2024 Tesla Model Y (Performance)

- 2024 Tesla Model Y (Rear Wheel Drive)

- 2023–2024 Tesla Model X

- 2022–2024 Chrysler Pacifica Plug-in Hybrid

- 2022–2024 Jeep Grand Cherokee 4xe

- 2022–2024 Jeep Wrangler 4xe

- 2022–2024 Lincoln Corsair Grand Touring

All of these cars qualify for some kind of tax breaks. Not all will get the full $7,500 credit, but something is better than nothing. The Inflation Reduction Act is trying to help people save money and decarbonize the country simultaneously. This list will expand as more affordable EVs roll off the production line.

If you believe you qualify for an EV tax break, check the VIN. It can tell you the car’s manufacturing origin and if it is eligible. Sorry to all the Fisker owners out there; it’s not on the list. Then again, you have a Fisker Ocean. Isn’t that a win on its own?