The Clean Investment Monitor (CIM) is a joint project launched in September 2023 by independent research provider Rhodium Group and MIT’s Center for Energy and Environmental Policy Research that tracks public and private sector investments in clean technologies across the United States since 2018. If there’s one major takeaway, it’s that clean energy investments are on the rise.

States in the Southern ($428 billion) and Western ($327 billion) regions are leading the charge, with their combined $755 billion in investments accounting for approximately 76% of the country’s total clean investments from 2018 through June 2024.

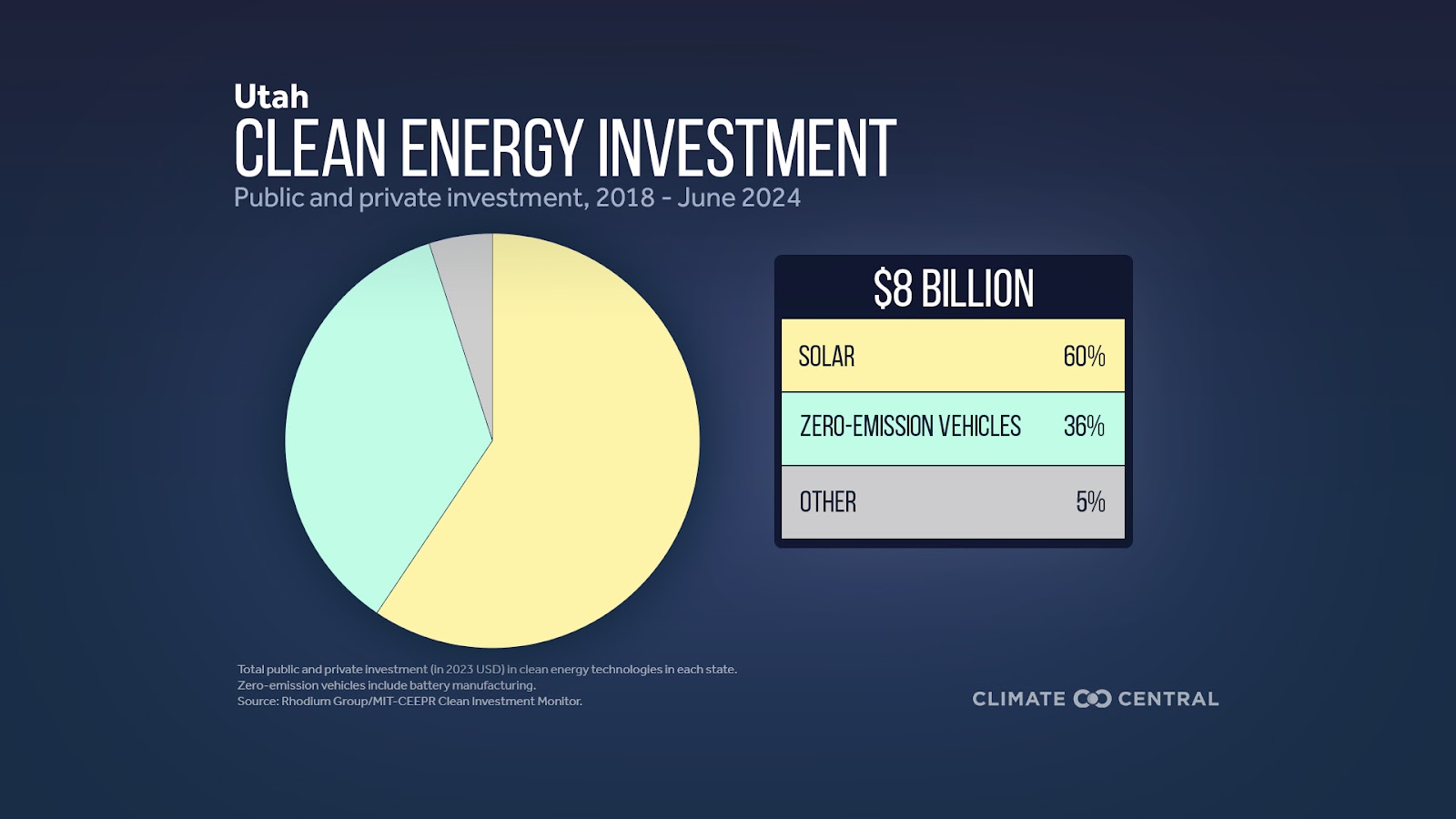

Utah received a total of $8 billion in investments during the CIM’s tracking period. Although it went to several sectors, the state’s economy and job sector have primarily benefited (or will benefit) from manufacturing, wind power, and solar energy.

Photo Courtesy Climate Central

These benefits come amidst recent forecasts of slowing economic activity in 2025. However, Phil Dean, chief economist at the University of Utah’s Kem C. Gardner Policy Institute and co-chair of the Utah Economic Council, highlighted the miraculous resilience of the U.S. economy,“Yet again, despite some dire predictions of higher interest rates forcing a hard landing, the remarkably resilient U.S. economy flew high in 2024 as post-pandemic economic normalization continued.”

His recent statement in the Utah Business journal was accompanied by two promising economic indicators: Utah’s nominal Gross Domestic Product (GDP) surpassed $300 billion for the first time, spurred in large part by its nation-leading GDP growth rate of 4.6% through the first three quarters of 2024. Plus, job growth continued at 1.7% despite the state’s population exceeding 3.5 million.

Photo Courtesy Climate Central

Economic success is in part due to investment into manufacturing, wind power, and solar energy. As seen in the above graphic from nonprofit Climate Central, 60% (~$4.8 billion) of Utah’s $8 billion in clean investments went to the solar sector, 36% (~$2.88 billion) to zero-emission vehicles (ZEVs), and the remaining 5% (~$400 million) to other industries. Utah was one of only 10 states where solar power was the most invested-in technology, and its total solar investments since 2018 put it in fourth place nationwide, behind only Texas, Florida, and Virginia. Not to be left out is wind energy, which, according to a Climate Central report, when combined with solar energy, is predicted to power more than 90% of the state’s energy by 2035.

Furthermore, the most recent CIM data on actual investments by state, as a percent of GDP over the last four quarters (the most recent being the third quarter (Q3) 2024) shows promising signs for Utah’s manufacturing sector, which, in CIM reporting, is defined as “the construction or expansion of factories that manufacture clean energy, clean vehicle, building electrification, or carbon.” Manufacturing’s 0.38% total of Utah’s GDP represented 42% of clean investments over the last four quarters, broken down into the following sectors:

- $1 billion to Solar (92% of Manufacturing)

- $87.713 million to Batteries (8% of Manufacturing)

Retail’s actual investment by state as a percentage of GDP was second at 0.33%, or 36% of the total, broken down into the following sectors:

- $812.4 million to ZEVs (84% of Retail)

- $124.6 million to Distributed Electricity and Storage (13% of Retail)

- $25.22 million to Heat Pumps (3% of Retail)

Energy and Industry, defined as “new or expanded facilities to produce clean energy, capture carbon dioxide emissions, or decarbonize industrial activity,” rounded out the remaining 22% of the total with its 0.2%, broken down into the following sectors:

- $423.8 million to Solar (72% of Energy and Industry)

- $119.2 million to Hydrogen (20% of Energy and Industry)

- $47.09 million to Storage (8% of Energy and Industry)

As Utah’s economy heads through 2025 and beyond, it is clear investments in clean energy will be right there with it, if not fueling the way, at least according to the numbers.