In February, the nonprofit Climate Power issued updates to its Clean Energy Boom Report, which details new investments and jobs spurred by the Inflation Reduction Act since it was passed on Aug. 16, 2022. Covering the 18 months until Feb. 28, 2024, the report counts announcements of $352.74 billion in investment for 523 new clean energy projects, creating 271,713 new jobs.

Photo Courtesy QCells

Overall Picture

The battery industry is responsible for the most projects, 163 (31.17% of the total), and the most jobs at 117,975 (43.42% of the total), followed by the electric vehicle (EV) industry with 117 projects (22.37%) and 54,385 jobs (20.02%), and the solar industry with 114 projects (21.8%) and 39,714 jobs (14.62%).

However, the most investment is going toward semiconductors and other clean technology at $124.66 billion (approximately 35.34% with rounding), followed by batteries at $109.92 billion (approx. 31.16%).

Other industries, including grid and transmission, hydrogen, and wind, are also seeing a significant amount of projects, job creation, and investment.

Although the clean energy projects span 47 states and Puerto Rico, several states stand out for generating the most action. Most projects are located in:

- Michigan (45)

- Georgia (40)

- Texas (38)

- California (36)

- South Carolina (29)

However, the most jobs are being generated in:

- Georgia (29,472)

- New York (26,082)

- Texas (23,315)

- Kansas (20,897)

- Michigan (20,107)

The most investment also differs slightly:

- New York ($115.04 billion)

- Georgia ($23.12 billion)

- Michigan ($21.53 billion)

- North Carolina ($18.75 billion)

- Texas ($16.05 billion)

Photo Courtesy Michigan Economic Development Corporation

Many of the communities being impacted are low-income, meaning their median income is under 200% of the federal poverty line. In 38 states, 228 new projects (43.59% of the total) are creating 105,182 new jobs (38.71%) and bringing $97.16 billion in investment (approximately 27.54%) to low-income areas.

Note that for this analysis, we went with the overall summation numbers listed in the main report rather than the appendix, which lists one extra project. Most of the projects in low-income areas are for EVs — with 71 projects (31.14% of the total in low-income areas) — followed by batteries with 65 (28.51%). That order was reversed in terms of jobs and investment, with batteries creating 34,479 jobs (32.78%) at $39.65 billion (approximately 40.81%) and EVs creating 31,655 jobs (30.1%) at $25.85 billion (approx. 26.61%).

Low-Income Communities

Most of these low-income projects are located in Georgia and South Carolina at 23 projects each, Michigan at 17, and Indiana, Tennessee, and Texas at 12 each. Meanwhile, most of the jobs were generated in Georgia (15,372), Texas (14,612), South Carolina (10,893), and Michigan (10,145).

The most investment in these low-income projects was in Texas ($13.47 billion), North Carolina ($12.97 billion), South Carolina ($10.98 billion), and Michigan ($8.55 billion).

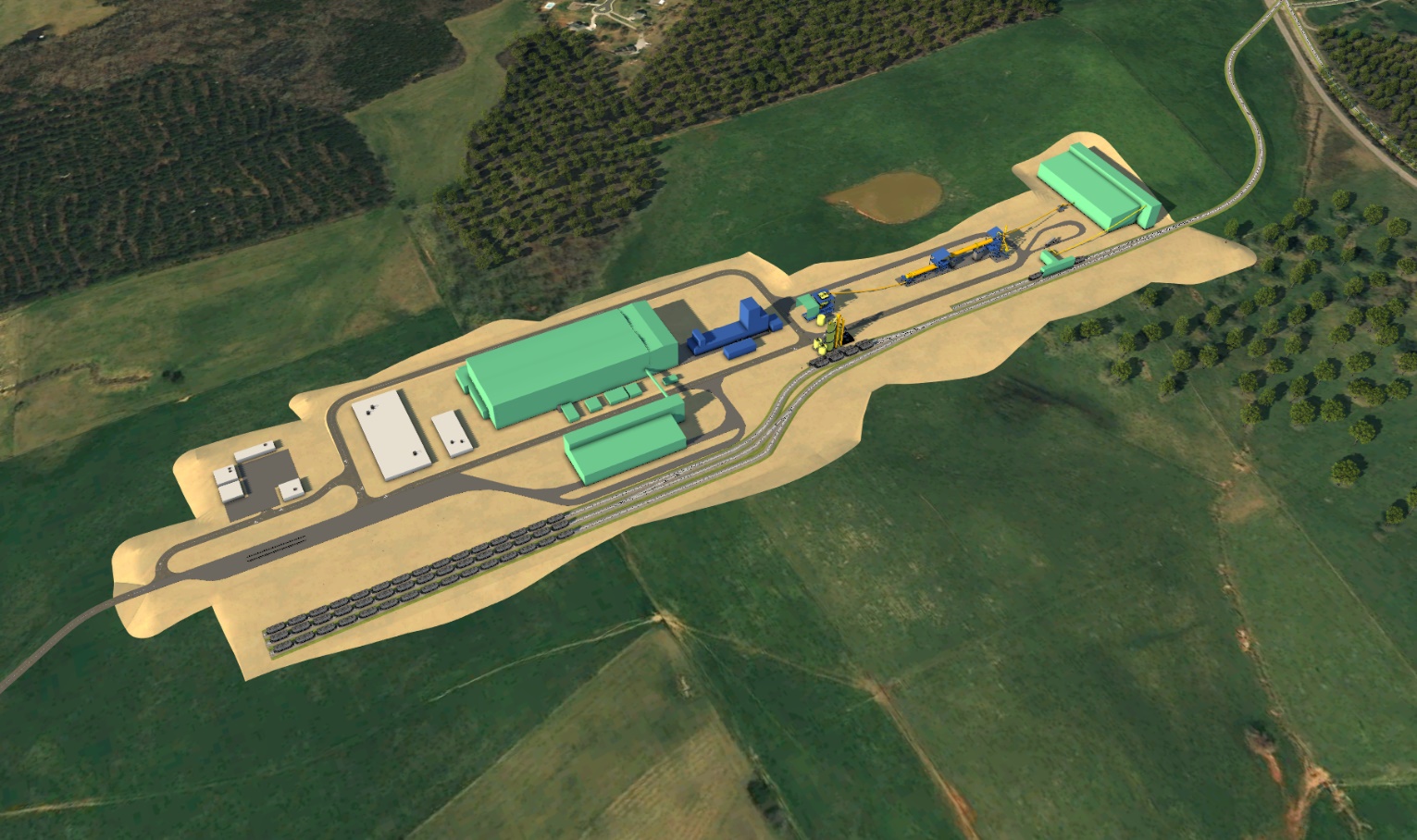

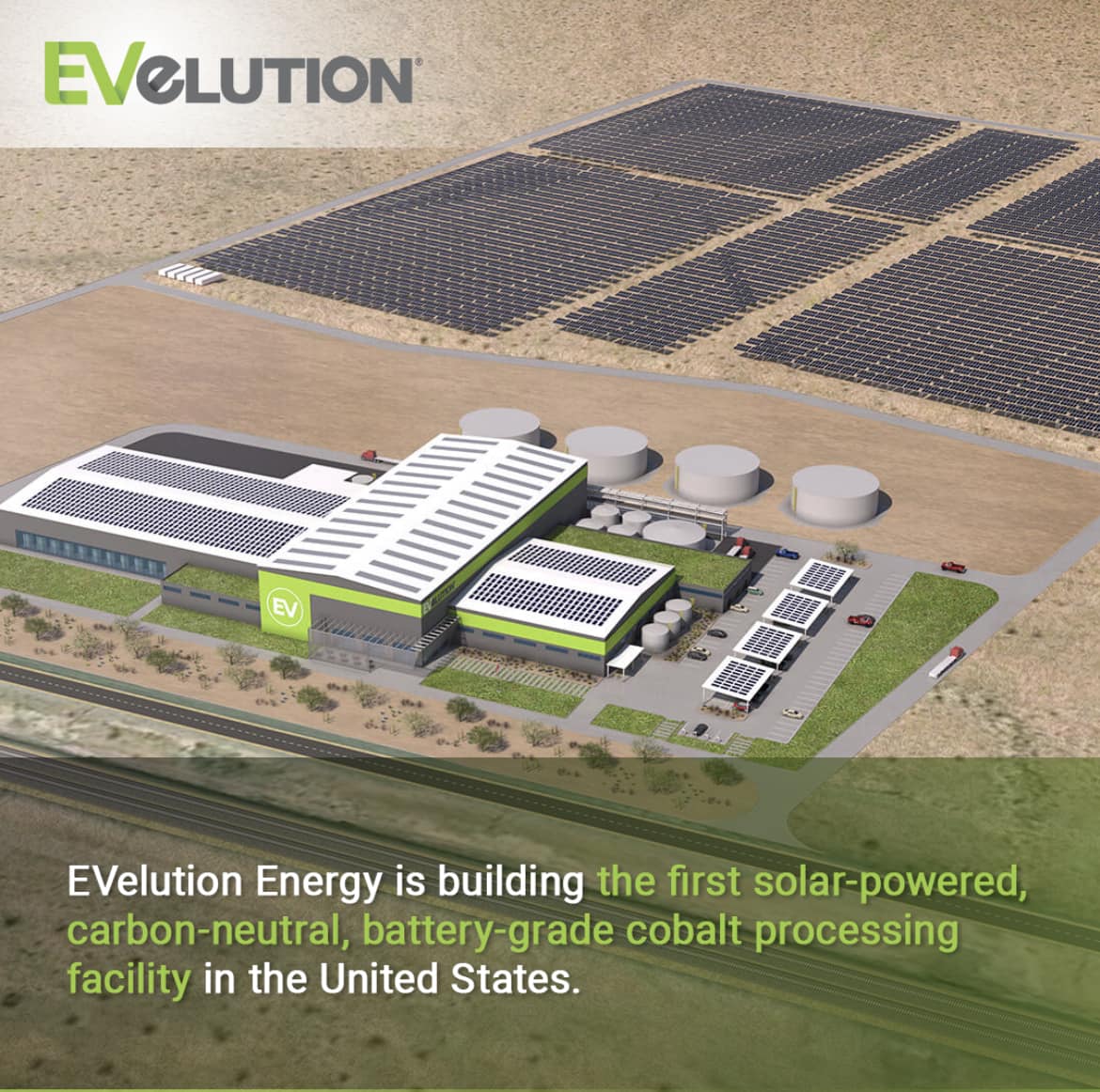

Obviously, low-income-focused projects are popping up in other states, too. For example, EVelution Energy is investing $200 million to build the U.S.’s first solar-powered cobalt sulfate production plant in Yuma County, Arizona. The county has a median household income of $48,790 and the highest unemployment rate in the state at 14.8%. The facility will employ 360 locals.

Meanwhile, in Pennsylvania, Eos Energy Enterprises is investing $500 million to expand its manufacturing plant in Turtle Creek. The location was at its height during World War II when it was operated by Westinghouse and left a gap when it moved in the 1980s. Eos’s Project American Made Zinc Energy aims to fill it with 50 construction jobs and 650 full-time ones. Both organizations are also working with local educational institutions to find new employees.

Photo Courtesy EVelution Energy

Rural Communities

These clean energy projects are also impacting rural communities.

In 31 states, 92 new ventures (17.59% of the total) are creating 43,570 jobs (16.04%) and funneling $44.93 billion in investment (approximately 12.74%) to rural areas.

Note that here, like for low-income projects, we used numbers listed in the main report rather than the appendix, which lists one extra project.

The battery industry led in all categories with 33 projects (35.87% of the total in rural areas), 20,805 jobs (47.75%), and $21.5 billion in investment (approx. 47.85%). The solar industry ranked second in projects and jobs with 20 projects (21.74%) and 8,751 jobs (20.08%), but EVs ranked second in investment with $10.31 billion (approx. 22.95%).

Most of these rural projects are located in Georgia, with 13, followed by North Carolina and South Carolina with seven each, and finally, according to the appendix, Tennessee and Texas had five each.

The most jobs were generated in North Carolina (5,558 jobs), Georgia (3,724), Oklahoma (3,515), South Carolina (3,197), and West Virginia (3,105). The most investment in these rural projects was in North Carolina ($17.01 billion), Kentucky ($2.98 billion), Michigan ($2.49 billion), Oklahoma ($2.45 billion), and Mississippi ($2.27 billion).

Photo Courtesy Redwood Materials

Congressional District Breakdown

Additionally, looking at Congressional districts, 274 projects (52.39% of the total) have been announced in 133 Republican districts, which will generate 144,532 jobs (53.19% of the total) and more than $262.19 billion in investment (approximately 74.33%).

Of these, the most jobs — 10,450 — will be generated in NV-2, represented by Rep. Mark Amodei (R), followed by 9,000 in NY-22 under Rep. Brandon Williams (R) and 7,222 in GA-1 under Rep. Earl Carter (R). Meanwhile, the most investment in a Republican district — $100 billion — is in NY-22, followed by $15 billion in ID-2 under Rep. Michael Simpson (R) and $11.87 billion in NC-9 under Rep. Richard Hudson (R).

The prevalence of Republican states can also be seen through a narrower lens. Of the 114 Congressional districts spanning 34 states that are investing in clean energy in low-income areas, the majority — 154 projects (67.54% of the total in low-income areas), 69,684 jobs (66.25%), and $75.84 billion in investment (approximately 78.06%) — are in Republican districts.

The districts generating the largest number of jobs in low-income areas are both in Texas: TX-14 under Rep. Randy Weber (R) with 5,247 jobs and TX-22 under Rep. Troy Nehls (R) with 4,600 jobs. Of the 63 Congressional districts across 28 states that are investing in clean energy in rural regions, the majority — 77 projects (83.70% of the total in rural areas), 34,338 jobs (78.81%), and $34.39 billion in investment (approximately 76.54%) — are in Republican districts. The districts generating the most jobs in rural areas are NC-9 under Rep. Richard Hudson (R), with 3,391 jobs, and WV-2 under Rep. Alexander Mooney (R), with 3,000 jobs.